ATM Business Calculator: How Long To Pay Off Your Machine?

ATM Business Projection Calculator

Calculate potential profits of an ATM machine business by entering the number of ATMs, numbers of transactions and expenses. You'll also see how long it might take to break-even on your ATM investment.

How to Use the ATM Business Calculator

I built this ATM business calculator to help entrepreneurs evaluate the profit potential of starting an ATM business. After researching industry data and speaking with successful ATM operators, I created this tool to give you realistic projections based on your specific costs, location arrangements, and transaction volumes.

This calculator takes into account the key variables that affect ATM profitability, including number of machines, monthly transactions, surcharge fees, location costs, and operational expenses. The results can help you determine if this business model is right for you and how long it will take to recoup your initial investment.

ATM Business Industry Overview

The ATM industry in the United States is a mature but still viable business opportunity for independent operators. While the number of ATMs has slightly declined in recent years (from 470,000 in 2019 to 451,500 in 2022 according to Euromonitor International data cited by the Wall Street Journal), there are still significant opportunities for entrepreneurs looking to enter this space.

The business model is straightforward: you purchase ATM machines, place them in high-traffic locations, and earn revenue from the surcharge fees customers pay when withdrawing cash. One of the most appealing aspects of the ATM business is the relatively passive income potential once the machines are placed and operating.

According to my research of thousands of independently owned ATMs, the average ATM processes between 100-300 transactions per month. National Cash reports the average ATM is used 300 times per month, while other industry sources cite ranges of 100-200 monthly transactions for typical locations.

Let's look at a real-world example from an ATM operator who shared his results:

In this example, the operator purchased an ATM for $2,700, placed it in a Mexican restaurant, and generated 80 withdrawals per month with a $3.50 transaction charge. After paying the restaurant a $40 monthly placement fee, the net profit was $240 per month. This represents a 10-11 month payback period on the initial investment.

Finding and Buying ATM Machines

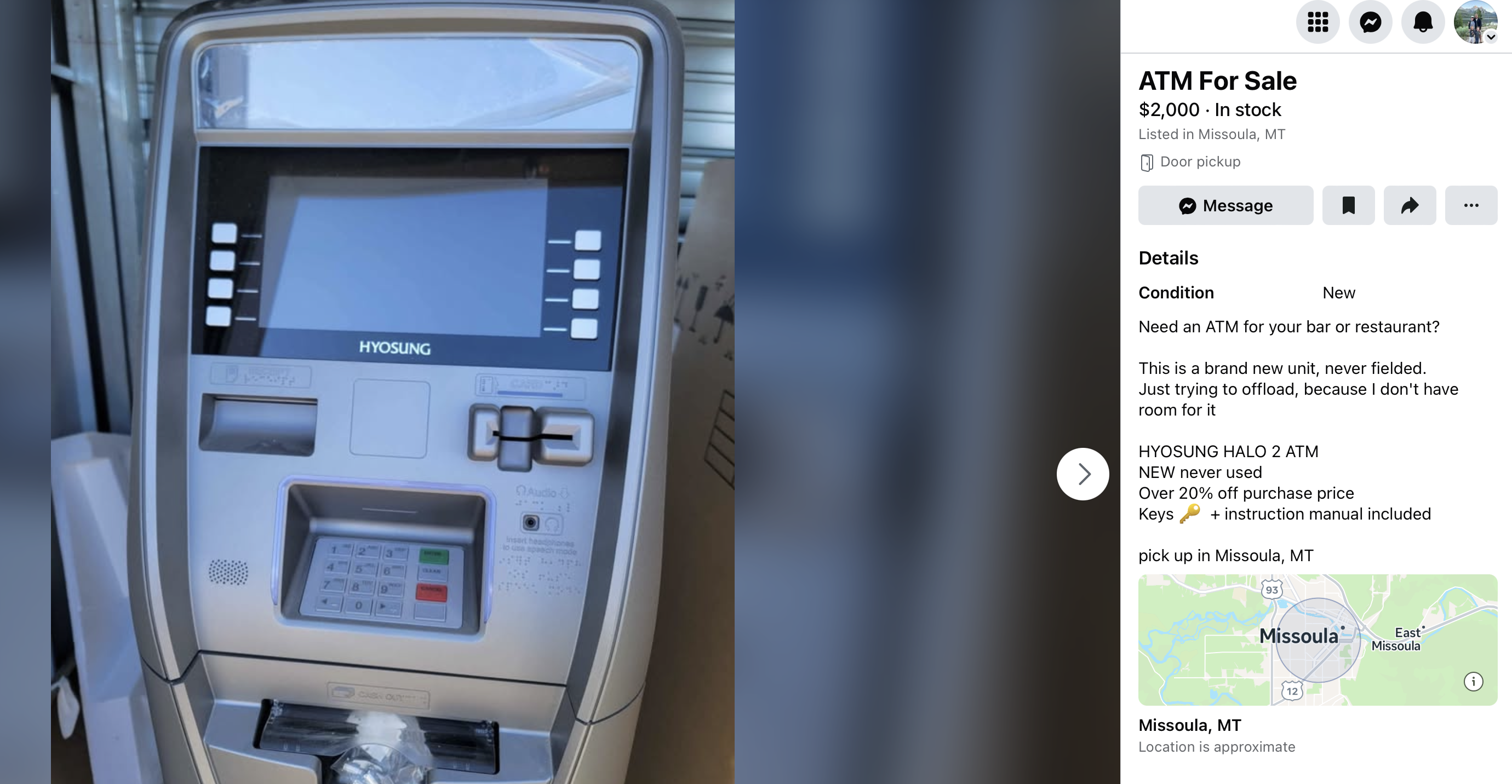

When starting an ATM business, one of your first decisions will be whether to buy new or used machines. New ATMs typically cost $2,000-$8,000 depending on the model and features, while used or refurbished units can be found for $1,000-$4,000.

In my research scouring Facebook Marketplace and Craigslist, I found many gently used ATMs available for around $2,000. Some were even brand new but being sold by owners who purchased them but never deployed them. This creates an opportunity to acquire equipment at below-retail prices.

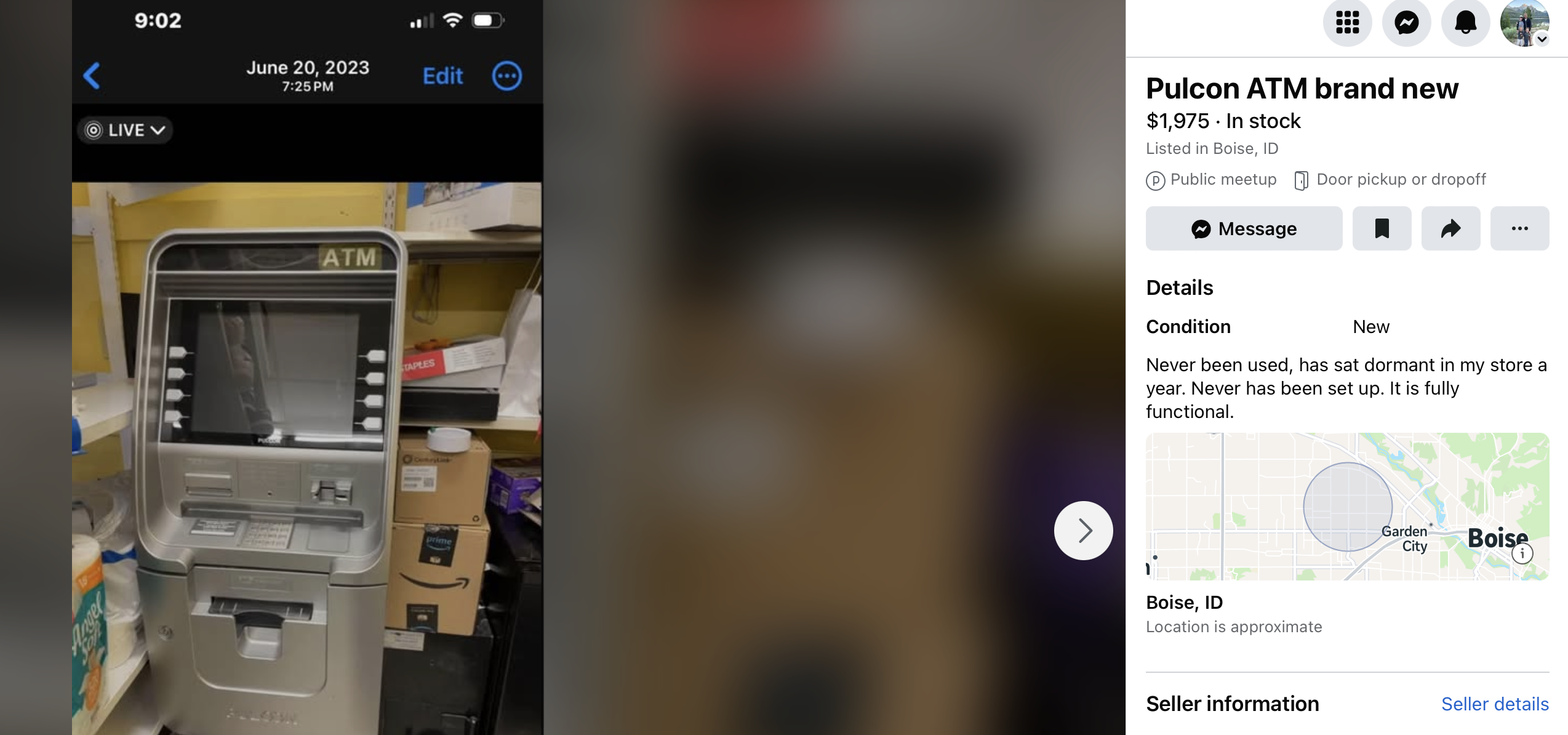

Just keep in mind that there's a learning curve on the setup process of these machines. I found multiple examples of people who bought ATMs and were now selling them unused. One seller in Boise had a machine sitting dormant in his storefront for more than a year and was selling it at a discount. Make sure this is a business you really want to learn.

Finding Profitable ATM Locations

The success of your ATM business will largely depend on selecting high-traffic locations where people need cash. Based on industry data, the most profitable locations typically include:

- Bars and nightclubs - Customers often need cash for tips and cover charges.

- Restaurants - Especially those that don't accept credit cards or have minimum purchase requirements.

- Convenience stores - High foot traffic with customers making small purchases.

- Hotels - Travelers often need access to cash.

- Gas stations - Convenient stops for people on the go.

- Festivals and events - Temporary high-traffic opportunities.

When evaluating potential locations, consider both foot traffic and the likelihood of ATM usage. A good rule of thumb is to assume a 2% conversion rate on your ATM machine based on the number of people that enter a store. So a store with 5,000 monthly visitors might generate approximately 100 ATM transactions.

Also consider safety factors when choosing locations. You want places where:

- The machine is less likely to be damaged or stolen.

- Video surveillance is available.

- You can safely restock the machine with cash.

- The business has reasonable operating hours for maintenance.

Step-by-Step Guide to Using the Calculator

Step 1: Enter Basic ATM Information

Start by entering:

- Business Name (optional)

- Number of ATMs (start with a realistic number you can manage)

- Monthly Transactions per ATM (industry average is 100-300)

- ATM Surcharge ($) - typical rates range from $2.50-$4.00

- Cost per ATM ($) - typical costs range from $1,500-$3,000 for used machines

Step 2: Select Location Arrangement

Choose the type of arrangement you have with property owners:

- No Fee - You place machines for free (ideal but rare for premium locations).

- Monthly Rental Fee - You pay a fixed monthly amount per machine (typically $50-$100).

- Revenue Share - You pay a percentage of surcharge fees (typically 10-30%) to the property owner.

Step 3: Advanced Options (Optional)

For a more precise analysis, enable Advanced Options to configure each ATM individually:

- Enter location descriptions

- Set machine-specific transaction volumes

- Customize surcharge fees for each machine

- Set different location arrangements for each machine

This feature is particularly useful if you have machines in varying locations with different performance levels, as no two locations will perform exactly the same.

Step 4: Add Monthly Expenses

Enter your regular expenses. Typical monthly expenses for an ATM business include:

- Wireless Subscription ($15-40 per machine)

- Cash Loading/Armored Car Service ($75-300 per month)

- Insurance ($10-30 per machine)

- Maintenance & Repairs ($20-50 per machine)

Step 5: Calculate and Analyze Results

Click "Calculate ATM Business Profits" to generate detailed financial projections including:

- Monthly and annual revenue

- Detailed breakdown of costs

- Net profit calculations

- Break-even analysis

- Visual charts showing performance metrics

The break-even analysis tab is particularly valuable as it shows how long it will take to recover your initial investment in the ATM machines. This section is a major differentiator among other ATM investing tools I've found online.

Make sure to consider the length of time it will take to become profitable on each machine. It's not uncommon for new ATM's to cost more than $5,000 or more per machine. It could take years for you to break-even on these machines depending on where they're placed.

The Reality of Running an ATM Business

While ATMs can provide a relatively passive income stream, it's important to understand the challenges of this business model too.

Cash Management

ATMs need to be stocked with cash, which means you'll need sufficient capital to keep them loaded. For an average ATM with 200 monthly transactions and an average withdrawal of $60-$80, you might need $12,000-$16,000 in cash reserves per machine.

Industry Decline

The growing trend toward cashless payments is impacting the ATM industry. According to Wall Street Journal reporting, the number of ATMs in the U.S. has declined from 470,000 in 2019 to 451,500 in 2022. Consider this long-term trend when planning your business. This means the pie is getting smaller for this service each year.

Competition

Prime locations are often already served by ATMs from banks or other independent operators. You'll need to develop a compelling value proposition for business owners to choose your machines over existing options or competitors.

Regulatory Requirements

ATM businesses must comply with various legal regulations, including Bank Secrecy Act requirements, ADA accessibility standards, and state-specific regulations. Factor in these compliance costs when planning your business.

Innovation

Keep in mind the ATM industry is going through a period of major innovation. For example, I've seen creative ATMs like the check cashing ATM below. You'll want to pay attention to innovation in this industry and try to find ways you can bring new machines and concepts to your local market.

How the ATM Calculator Works

I built this calculator using standard business financial modeling principles specific to the ATM industry.

Core Financial Calculations

| Metric | Formula | Example |

|---|---|---|

| Monthly Revenue per ATM | Monthly Transactions × Surcharge Fee | 200 × $3.50 = $700 |

| Location Fees (Revenue Share) | Monthly Revenue × Revenue Share Percentage | $700 × 20% = $140 |

| Total Location Fees | Sum of all ATM location fees | $50 + $140 + $100 = $290 |

| Total Monthly Revenue | Sum of all ATM revenues | $525 + $937.50 + $650 = $2,112.50 |

| Total Monthly Costs | Total Location Fees + Total Monthly Expenses | $384.38 + $375 = $759.38 |

| Net Monthly Profit | Total Monthly Revenue - Total Monthly Costs | $2,112.50 - $759.38 = $1,353.12 |

| Break-Even Months | Total Investment ÷ Net Monthly Profit | $7,500 ÷ $1,353.12 = 5.54 months |

Location Arrangement Calculations

The calculator handles three different types of location arrangements:

This ATM business calculator helps you decide whether starting an ATM business makes sense for your situation. While there are challenges to consider, especially with the gradual shift toward cashless payments, the relatively low startup costs and potential for passive income make it an attractive option for entrepreneurs looking to test a new income stream.

What I like most about this business model is that it's something you can start part-time with a single machine. As I've shown you, you can often pick up a used ATM machine for a couple grand to test drive the business. If you don't like the business, you can always sell the machine on Facebook Marketplace again and recoup a portion of your investment. If the business does work out, you can add more machines and grow.