Time Card Calculator - Determine Work Hours & Overtime Pay

Use this free calculator to track work hours, calculate overtime, and create professional time cards.

How to use the Time Card Calculator

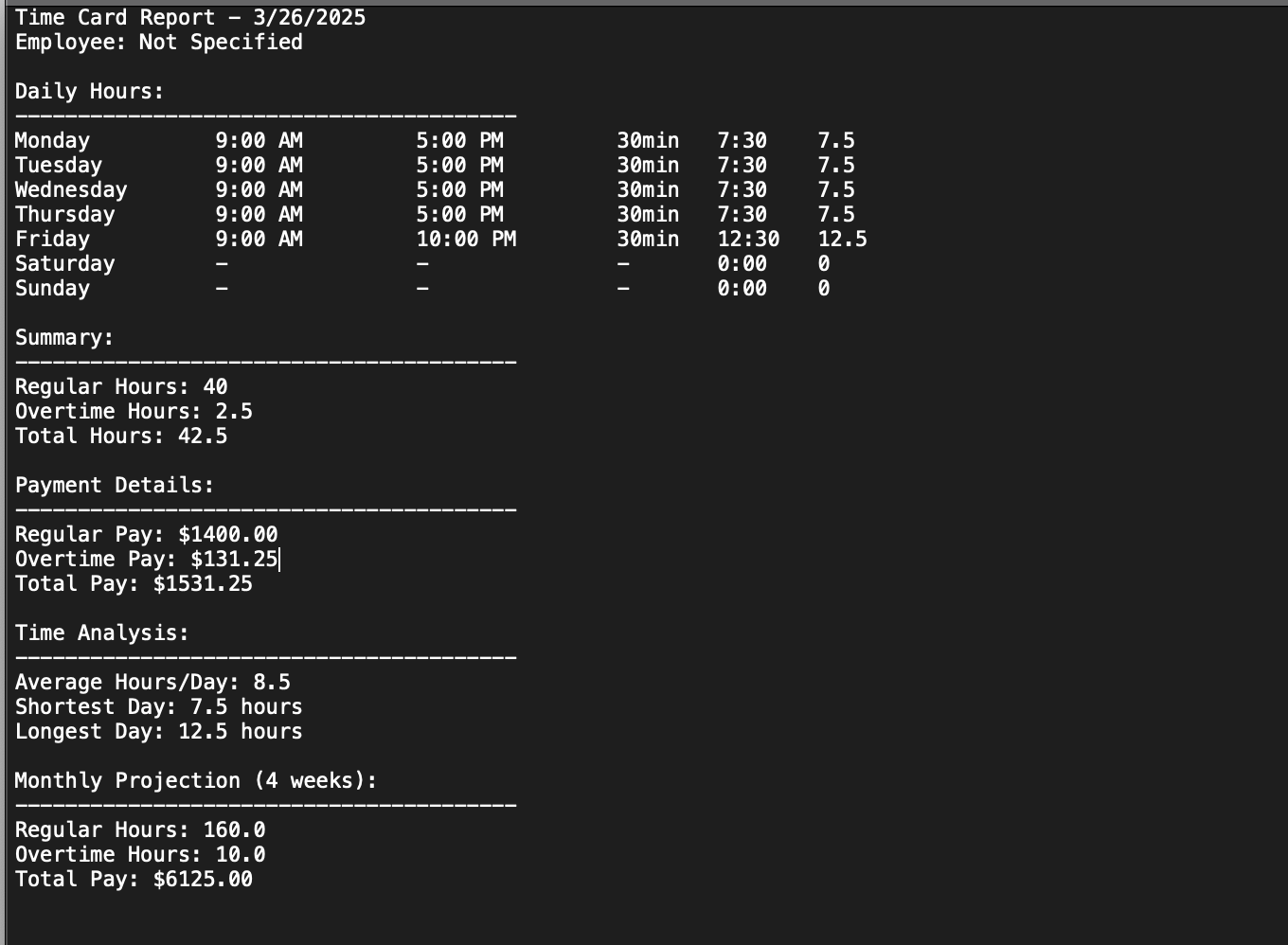

This work hours calculator tracks employee time by calculating the hours between start and end times while accounting for breaks. This supports most work schedules including overnight / weekend shifts and generates professional timecards, and display gross pay based on the hourly and overtime pay inputs.

Understanding Time Card Calculations

The calculator performs several key calculations to generate accurate time cards:

- Daily Hours: Subtracts end time from start time and deducts breaks.

- Weekly Totals: Adds up all daily hours worked.

- Overtime Calculation: Applies your selected overtime rules to determine regular vs. overtime hours.

- Financial Projections: Computes pay amounts based on hourly rates and overtime multipliers.

- Monthly Estimates: Projects your weekly figures to monthly totals (based on 4 weeks).

Overtime Calculation Methods

The calculator offers multiple overtime calculation options to match your needs:

- No Overtime Rate: All hours are paid at the base hourly rate regardless of hours worked.

- Daily Maximum: Caps payable hours at a specified daily limit (typically 8 hours).

- Weekly Maximum: Caps payable hours at a specified weekly limit (typically 40 hours).

- Daily Overtime: Applies overtime rates for hours exceeding a daily threshold.

- Weekly Overtime: Applies overtime rates for hours exceeding a weekly threshold.

Time Card Management

To get the most out of the Work Hours Calculator:

- Enter precise start and end times in 24-hour format (e.g., 17:30 for 5:30 PM).

- Include all break times, even short ones, for accurate calculations.

- Select the overtime calculation method that matches your company policy or local regulations.

- Use the "Copy Mon-Fri from Monday" feature to quickly set consistent schedules.

- Save or print time cards regularly for your payroll and record-keeping needs.

- Compare monthly projections to actual results to improve scheduling efficiency.

Legal Considerations for Time Tracking

When implementing time tracking in your business, understanding the legal framework is essential for compliance and fair labor practices. The Fair Labor Standards Act (FLSA) establishes federal requirements that every employer must follow, including maintaining accurate time records for a minimum of two years. These records should document hours worked each day and week, along with total earnings per pay period.

Beyond federal regulations, state laws often impose additional record-keeping requirements that may extend the retention period or mandate specific information be included in time records like holiday pay. For example, California requires employers to maintain time records for three years and include meal break periods in those records.

Break requirements represent one of the most varied aspects of labor laws across states. While federal law doesn't mandate meal or rest breaks, many states have implemented their own requirements. For example, California requires a 30-minute unpaid meal break for shifts over 5 hours, while Colorado mandates a 30-minute meal period after 5 hours and additional paid 10-minute rest breaks throughout the workday.

Lunch breaks specifically require careful tracking since they're typically unpaid periods. This calculator handles lunch and other breaks by allowing you to enter break durations in minutes for each workday, automatically deducting this time from total hours worked. When an employee takes a 30-minute lunch break during an 8-hour shift (9:00 AM to 5:00 PM), the calculator recognizes this as 7.5 hours of compensable work time rather than 8 hours. This distinction is critical for compliant payroll processing and accurate overtime calculations.

Overtime regulations present another layer of complexity with notable differences between federal and state laws. While federal law requires overtime pay at 1.5 times the regular rate for hours worked beyond 40 in a workweek, some states impose additional requirements. California, for example, requires daily overtime for hours worked beyond 8 in a single day, regardless of the weekly total. The work hours calculator accommodates these different approaches through its flexible overtime options, allowing you to select the method that aligns with your applicable regulations.

It's also worth noting that certain industries have specific exemptions or special rules for overtime. Healthcare, transportation, agricultural workers, and certain commissioned sales employees may fall under different overtime calculation rules. Furthermore, exempt employees (typically executive, administrative, and professional staff meeting specific criteria) aren't entitled to overtime pay regardless of hours worked.

This tool provides a powerful tool for tracking and calculating work hours in most standard employment situations, consulting with a payroll professional or employment law attorney is recommended to ensure your time tracking practices fully comply with all applicable regulations in your specific industry and location.