Wondering how much money you need to achieve financial independence? This Financial Independence Calculator helps determine your “freedom number” and estimates how long it will take to reach your goal of doing whatever it is you feel like with your time.

Financial Independence Calculator

Monthly Expenses

Safety Margin

Passive Income Sources

Monthly Savings

Results

Important Note: This tool assumes an average rate of return of 10% based on historical performance of S&P 500. Your results and timeline could vary significantly based on market performance, inflation, and other factors. This calculator is for educational purposes only and should not be considered as financial advice.

How to use this calculator

1. Monthly Expenses

Start by listing all your monthly expenses. The calculator provides common expense categories by default:

- Rent/Mortgage ($1,800)

- Utilities ($250)

- Groceries ($500)

You can modify these amounts or add/remove categories to match your lifestyle. Be thorough include everything you spend money on regularly to make the results as accurate as possible.

2. Safety Margin

The safety margin adds a buffer to your expenses to account for unexpected costs (car breaks down, kid needs braces) or small expenses that aren’t fixed like going out for coffee.

The default is set to 20%, meaning if your monthly expenses are $4,000, the calculator will plan for $4,800 ($4,000 × 1.20) in monthly passive income. If you’re really good at budgeting and disciplined financially, you can reduce this number down to 10% since you’ll have a more fixed spending range.

A stack of personal finance / marketing books that inspired this tool.

3. Passive Income Sources

List any existing sources of passive income:

- Rental property income

- Dividend payments

- Interest from savings accounts

- Royalties

- Business income that’s semi passive

- Payments from parents

4. Monthly Savings

Enter how much you can save each month toward your financial independence goal. This helps calculate how long it will take to reach your target.

In this tool, I assume you’ll get an average annual rate of return of 10% by investing in the S&P 500. The 10% average annual return assumption is based on historical S&P 500 performance. Actual returns will vary year to year.

Understanding the results

Monthly Required Passive Income: This is the amount of money you’ll need to cover all your monthly expenses.

Monthly Required Passive Income = Total Monthly Expenses × (1 + Safety Margin)

Example:

$4,000 monthly expenses × (1 + 0.20) = $4,800 required monthly passive income

Yearly Required Passive Income: The amount of money you’ll need to cover your annual expenses.

Yearly Required Passive Income = Monthly Required Passive Income × 12

Example:

$4,800 × 12 = $57,600 required yearly passive income

Required Investment Capital: The calculator uses the widely-accepted 4% Rule (also known as the Safe Withdrawal Rate) to determine your required investment capital. This rule, based on the Trinity Study, suggests you can withdraw 4% of your investment portfolio annually with a high probability of never running out of money depending on how long you live.

Required Investment Capital = Yearly Required Passive Income ÷ 0.04

Example:

$57,600 ÷ 0.04 = $1,440,000 required investment capital

Time to Reach Financial Freedom: The calculator estimates how long it will take to reach your goal using:

- Your current passive income (converted to equivalent capital using the 4% rule)

- Your monthly savings

- An assumed 10% average annual return based on historical S&P 500 performance

The formula uses compound interest calculations:

Months to Goal = ln(1 + (Remaining Capital × Monthly Return) ÷ Monthly Savings) ÷ ln(1 + Monthly Return)

Where:

- Monthly Return = 10% ÷ 12 = 0.833%

- Remaining Capital = Required Capital - Current Capital

- Current Capital = (Current Monthly Passive Income × 12) ÷ 0.04

Can you fast-track your financial freedom?

While your financial freedom number might look daunting at first, there are two main levers you can pull to reach it faster: reducing expenses and increasing income. Let’s run some numbers through our calculator to see the dramatic impact each approach can have on the calculator results.

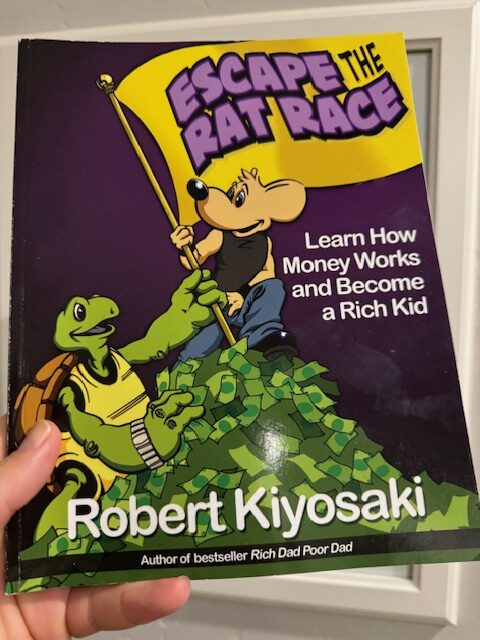

Escape the Rat Race book defines an asset as something that puts money into your pocket every month.

Strategy 1: Massively Cut Expenses Approach

One way to massively cut costs would be to cut out the monthly rent or mortgage payment. According to 2023 data, half of all U.S. renters spend 30% of their income on housing.

So if you can do something extreme and move back in with your parents or a relative for awhile that can really impact your investable savings amount.

(Reader Note: I Can’t Take this path because I’m in My 40s and My Wife Would Leave Me 😅)

Drastically reduce the amount of time needed to reach financial freedom by cutting out rent.

Let’s use our default calculator settings and remove that pesky $1,800 monthly rent/mortgage payment. While moving back in with your parents might not be everyone’s cup of tea (and definitely not mine unless I want to hear “When are you going to get a real job?” at every family dinner), the math is pretty compelling:

Original Scenario (Default Settings):

- Monthly Expenses: $3,890

- Required Monthly Passive Income (with 20% safety margin): $4,668

- Required Investment Capital: $1,400,400

- Time to Freedom (saving $500/month): 34.2 years

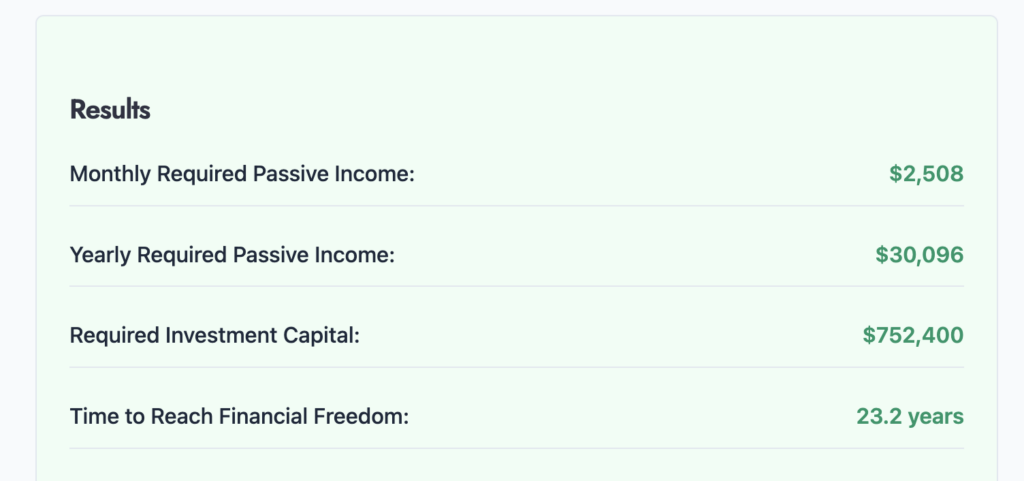

No Rent Scenario:

- Monthly Expenses: $2,090

- Required Monthly Passive Income (with 20% safety margin): $2,508

- Required Investment Capital: $752,400

- Time to Freedom (saving $2,300/month)*: 11.8 years

*Note: I assumed you’re saving your entire previous rent payment ($1,800) plus the original $500 monthly savings.

That’s a reduction of 22.4 years to freedom! Plus, mom’s cooking is probably better than your meal prep anyway. For younger folks starting their journey, this strategy could be a life-changer, even if it’s just for a few years to supercharge investments.

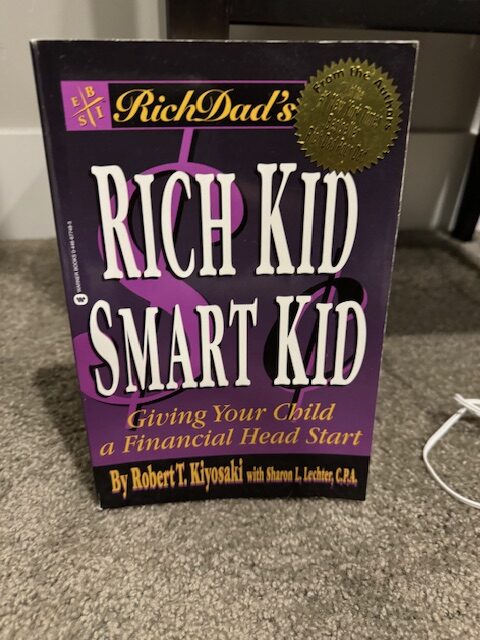

The Rich Dad series of book teach you to increase your cash flow and buy assets to build wealth.

Strategy 2: The “Income Maximizer” Approach

Now let’s look at the other side of the equation: increasing your income and savings rate. Here are some ways to boost your cash flow:

- Ask for that overdue raise (with data to back it up)

- Start a side hustle (freelancing, consulting, or creating digital products)

- Develop new high-income skills

- Create additional passive income streams

Let’s run the numbers assuming you keep your expenses the same but increase your monthly savings through higher income:

Original Scenario (Saving $500/month):

- Required Investment Capital: $1,400,400

- Time to Freedom: 34.2 years

Increased Savings Scenarios:

- Double Your Savings ($1,000/month):

- Time to Freedom: 25.1 years

- Years Saved: 9.1 years

- Aggressive Savings ($2,000/month):

- Time to Freedom: 18.3 years

- Years Saved: 15.9 years

- Side Hustle Hero ($3,000/month):

- Time to Freedom: 14.7 years

- Years Saved: 19.5 years

The Power of Combining Strategies

The real magic happens when you combine both approaches. Let’s say you:

- Move somewhere cheaper (saving $900 in housing)

- Start a side hustle (earning extra $1,000/month)

- Get a raise (extra $500/month)

This gives you an additional $2,400/month to invest while reducing your required investment capital. Running these numbers:

- New Monthly Expenses: $2,990

- Required Investment Capital: $1,077,600

- New Monthly Savings: $2,900

- Time to Freedom: 10.3 years

You’ve just cut your time to financial freedom by 23.9 years!

Remember, financial independence is a journey that requires patience, discipline, and regular monitoring of your progress. Use this calculator as a starting point to create your personalized path to financial freedom.

Related tools:

How long will it take to make $1 million at my job?: Now that you know your financial freedom number, it’s time to take a look at how long it will take to earn and save a million bucks at your current job.