How Long to Make $1 Million at Your Job? (Calculator)

$1 Million Dollars from Work Calculator

Calculate your path to $1 million based on your income and expenses.

How to Use This Calculator

This calculator helps you understand how long it will take to accumulate $1 million through your job income, considering various factors like taxes, expenses, and investment returns. It provides realistic projections based on your specific financial situation.

Start by entering your income details:

- Income Type: Choose between annual salary or hourly wage

- Income Amount: Enter your pre-tax income (default: $75,000 annually or $17/hour)

- Tax Filing Status: Select single or married to calculate tax impact

- Monthly Expenses: Include all regular monthly costs (default: $4,641)

Investment Settings

Configure your investment parameters:

- Investment Returns: Set expected annual return rate (0-14%, default: 7%)

- Current Age: Enter your age to track timeline progress (5-99 years)

Understanding Your Results

The calculator provides four different scenarios to reach $1 million:

- Gross Income: Time needed based on total income before taxes

- After Tax Income: Timeline adjusted for tax impact

- After Taxes + Expenses: Realistic timeline considering living costs

- Invested Amount: Accelerated timeline with compound investment returns

Tax Rate Calculations

The calculator uses 2023 tax brackets to estimate your effective tax rate. Keep in mind that tax rates change every year. This is just an estimate.

Single Tax Brackets:

37% for income over $578,126

35% for income over $231,251

32% for income over $182,101

24% for income over $95,376

22% for income over $44,726

12% for income over $11,001

10% for income up to $11,000

Married Tax Brackets:

37% for income over $693,751

35% for income over $462,501

32% for income over $364,201

24% for income over $190,751

22% for income over $89,451

12% for income over $22,001

10% for income up to $22,000

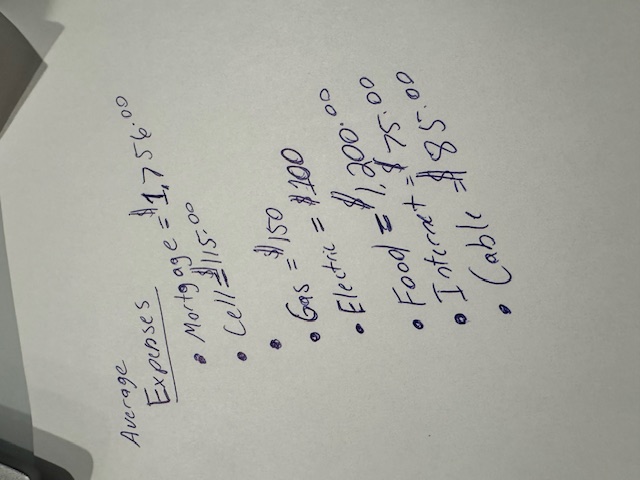

Average Monthly Expenses

Figuring out your average monthly expenses is essential for the accuracy of this report. To get the best results, take the time to write down what you spend money on every month including groceries, utilities, phone, internet, insurance, transportation, rent, and entertainment. The more detailed list of monthly expenses you can account for the more accurate your calculations.

By default, I entered $4,163 in average monthly expenses as the default based on the average monthly expenses by household size provided by Ramsey Solutions. Based on the same article married couples without kids can expect $7,390 in monthly expenses. A family of four can expect to spend $8,450 per month.

How much can you save from your paycheck?

There's an old saying that goes something like: "It doesn't matter how much you make. It's the amount of money you're able to save that's important." I happen to agree with the overall sentiment of this proverb.

The reality is it's hard to hold onto money in today's society. We are taxed a lot and there's a certain amount of overhead each of needs to cover just to live including food, electricity, transportation rent or a mortgage. What's even crazier is this calculator only takes into consideration your federal tax. When you consider state income tax and sales tax rates that average 5% – 7%, it's not easy to reach $1 million dollars in personal savings by way of a bi-weekly paycheck.

What can you do to save a million dollars faster?

If you're feeling discouraged by the results in this calculator, I have some good news for you. Everyone can make $1 million dollars even on a low income. I entered the average salary of an employee of $63,795 per year into income field and the calculator estimates it will take 15 years and 9 months to gross a million.

But it's not all doom and gloom! I have some good news for you too. Here are some actionable strategies that can help speed up your journey without having to switch jobs entirely:

- Ask for an Annual Raise: Don't underestimate the power of consistent, small raises. Even a 3% annual raise compounded over time can add up significantly. If you can demonstrate your value, aim higher. A raise not only boosts your income but can increase your 401K contributions or any employer matches, pushing you closer to the million-dollar mark.

- Put in Extra Hours or Work Overtime: While working overtime isn't sustainable for everyone, it can be a great short-term boost to your income. Just a few extra hours each week can translate to thousands of dollars a year. If your workplace offers overtime pay, this can be a strategic way to increase your savings without making drastic changes.

- Maximize Your 401K or IRA Contributions: Investing in a tax-deferred plan like a 401K not only reduces your taxable income today, but it also sets you up for significant growth over time. The average stock market appreciation is about 7-8% annually, which can lead to substantial wealth over a long time horizon. Plus, many employers offer a 401K match—free money that accelerates your path to $1 million.

- Start a Side Hustle or Small Business: While your day job covers your main expenses, a side hustle can be the difference-maker that propels you toward your financial goals faster. Whether it's freelancing, selling products online, or mowing a few lawns on during your weekends, a small monthly side income can shave years off the time it takes to reach $1 million.

A Little Hope

Hitting $1 million might seem out of reach, but you have more options than you think. By making small adjustments, staying consistent, and leveraging these strategies, you'll be surprised how much faster you can get there. It's all about stacking incremental gains and making your money work for you.