The Psychology of Money Inspired: Financial Archetype Calculator

Discover your financial archetype based on Morgan Housel's principles in the "The Psychology of Money." Get personalized insights about financial biases and money-mindset.

Discover Your Financial Archetype

Everyone has hidden biases, behaviors, and emotional triggers that shape their financial decisions. This tool, inspired by Morgan Housel's "The Psychology of Money," will help you understand yours.

Takes about 5 minutes to complete

How This Tool Works

Answer Questions

You'll respond to 22 questions about your finances, behaviors, and attitudes toward money.

Discover Your Archetype

We'll analyze your responses and identify your primary and secondary financial archetypes.

Get Personalized Tips

Receive insights and actionable advice based on your unique financial psychology profile.

How to Use the Financial Archetype Calculator

I built this financial archetype calculator after being profoundly impacted by Morgan Housel's "The Psychology of Money." My goal with this tool is to help you understand your financial mindset, biases, and behaviors that influence how you manage money. By answering questions about your financial situation and behaviors, you'll discover your primary financial archetype and that might just benefit your wealth-building journey. Or at the very least give you some food for thought.

This calculator examines both your financial metrics and your behavioral patterns related to money. Based on my own life experience and the principles from Housel's book, I came up with ten distinct financial archetypes, each with unique strengths, blind spots, and growth opportunities.

My Personal Money Psychology Journey

My relationship with money has been complicated. I came out of college with over $40,000 in combined student loan and credit card debt. I quickly learned what it's like to live paycheck to paycheck and the harsh reality that missing just one payment could trigger a financial collapse affecting everything from my car to my rent. This experience created significant stress and profoundly shaped my relationship with money for many years.

Reading "The Psychology of Money" was eye-opening for me because I had never considered the emotional impact being in debt had on my life. It helped me understand that what we experience with money plays a massive role in our feelings and behaviors around it. It's one thing to read about the Great Depression in a textbook, but an entirely different experience to understand the feelings of losing a job or going without necessities. I've come to realize that personal finance is so much more than digits in a spreadsheet. For better or worse, our financial situation often dictates how we feel about ourselves and influences our self-perception.

This calculator is my way of helping others understand their own money psychology and how their experiences have shaped their financial decisions in an interactive way.

The Science Behind Financial Archetypes

My research into financial psychology and Morgan Housel's work reveals that our money decisions are driven by a complex mix of experiences, emotions, and cognitive biases. The archetypes in this calculator are derived from analyzing common behavioral patterns that determine financial success or struggle. I also wanted to build something that would help inspire people to improve their own financial situation no matter what financial mindset you have.

Each archetype represents a cluster of related behaviors and biases. For example, the "Patient Builder" archetype (exemplified by Warren Buffett) demonstrates the value of long-term thinking and emotional stability during market volatility—key themes in Housel's book.

The calculator assesses your responses across multiple dimensions referenced in Housel's book, including:

- Loss aversion: How you react to financial setbacks or market drops.

- Overconfidence: Your assessment of your ability to predict financial outcomes.

- Herd mentality: Whether you tend to follow investment trends.

- Impulsivity: How patient you are with financial decisions.

- Status-seeking: How much appearance of wealth matters to you.

- Time horizon: How long you're willing to wait for financial results.

Financial Input Research

The financial metrics collected in the calculator (income trajectory, savings rate, net worth, and debt levels) provide context for your behavioral responses. Research shows these objective measures are critical for accurately assessing your financial psychology.

For example, someone who shows low loss aversion with minimal savings might be categorized differently than someone showing the same behavioral trait but with substantial financial reserves. The former might be an "Impulsive Adventurer" while the latter could be a "Maverick Trailblazer." Different archetypes with different recommendations.

Step-by-Step Guide to Using the Calculator

Step 1: Enter Financial Information

Start by entering your basic financial details:

- Current annual income

- Income from three years ago (to calculate trajectory)

- Monthly savings amount

- Current net worth

- Non-mortgage debt

These inputs help establish your financial context. According to my research, income trajectory (whether growing or declining) significantly influences risk tolerance and financial behaviors. Estimates are fine—the precise dollar amounts aren't critical.

Step 2: Answer Behavioral Questions

You'll answer 17 carefully designed questions about your financial behaviors and attitudes. These questions were inspired by principles from "The Psychology of Money" and measure biases.

- How you respond to market volatility.

- What motivates your spending decisions.

- How you define "enough" in your financial life.

- Your approach to risk and opportunity.

- How you compare yourself to others financially.

Step 3: View Your Results

After completing the questions, you'll receive a financial psychology profile.

- Your primary and secondary archetypes. After all, we humans are complex creatures.

- Analysis of your financial trajectory and savings behavior.

- Identification of your dominant biases.

- Your financial psychology mindset score.

- Personalized strengths and potential blind spots.

- A real-world example of someone who shares your archetype.

Step 4: Review Actionable Tips

The calculator provides customized recommendations based on your archetype, including:

- Archetype-specific financial strategies.

- Tips tailored to your financial situation.

- Wisdom from "The Psychology of Money" relevant to your profile.

- Suggested calculators and tools for your next steps.

The Ten Financial Archetypes and How They're Determined

My research and analysis of Housel's principles led me to come up with these ten financial archetypes. I wanted to pick a collection of successful people that seemed to fit different mental models so anyone could be inspired to improve their financial situation regardless of the inputs you put into the tool. Your archetype is determined by your behavioral responses and financial metrics, with each archetype having a specific scoring profile.

To be assigned a specific archetype as your primary profile, your responses need to accumulate a certain number of points for that archetype. The algorithm weighs different questions differently (some questions have 3× impact while others have 1×) and also applies modifiers based on your financial situation. Here's how the archetypes break down:

1. Patient Builder

Like Warren Buffett, you focus on long-term wealth through consistent saving and investing. You embody Housel's belief that time is the greatest asset and understand that compounding works best with patience.

Score Profile: To become a Patient Builder, you typically need to score 40+ points in this category. Your score is boosted significantly by having a high savings rate (+5 points), excellent financial health (+5 points), and stable income (+3 points). Patient Builders tend to select answers showing low risk-taking, disciplined saving habits, and calm responses to market volatility.

2. Cautious Optimist

Like Benjamin Franklin, you balance optimism with prudence. You align with Housel's emphasis on maintaining a margin of safety while still pursuing growth opportunities.

Score Profile: Cautious Optimists typically reach 35+ points. This score increases with stable income (+5 points) and moderate savings rate (+3 points). You likely selected answers showing moderate risk tolerance, careful planning, and a balance between safety and growth in your investment approach.

3. Resilient Saver

Like John D. Rockefeller, you prioritize financial security and saving aggressively. You reflect Housel's focus on the importance of survival and preparation for market volatility.

Score Profile: Resilient Savers score 35+ points, with significant bonuses for high savings rate (+5 points) and declining income (+5 points, with an additional +3 for significant decline). You likely selected answers demonstrating loss aversion, emergency preparation, and prioritizing financial security over growth.

4. Visionary Risk-Taker

Like Elon Musk, you chase big ideas and embrace calculated risks. You connect with Housel's insights about innovation while needing to guard against the hubris he warns about.

Score Profile: Visionary Risk-Takers reach 35+ points, with significant boosts from growing income (+5 points) and even challenging financial health situations (+3 points). Your answers likely showed comfort with volatility, willingness to take calculated risks, and optimism about financial innovations.

5. Status Seeker

Like early-career Oprah Winfrey, you may focus on outward appearances of success. This connects to Housel's principle that "wealth is what you don't see" and the challenge of prioritizing substance over appearance.

Score Profile: Status Seekers typically score 30+ points, with significant bonuses from growing income (+3 points) and low savings rate (+5 points). Your responses likely indicated social comparison influences, spending on visible status markers, and sensitivity to others' financial achievements.

6. Impulsive Adventurer

Like Richard Branson, you make quick financial decisions driven by instinct. This relates to Housel's discussions about the role of luck and the importance of adapting to circumstances.

Score Profile: Impulsive Adventurers score 30+ points, receiving boosts from low savings rate (+5 points) and concerning financial health (+3 points). Your answers likely revealed quick decision-making, comfort with acting on intuition, and flexibility in financial approaches.

7. Trend Follower

Like early Mark Cuban, you may be swayed by market trends. This connects to Housel's warnings about crowd-following behavior and FOMO (fear of missing out).

Score Profile: Trend Followers typically accumulate 30+ points, with increases from having no savings (+3 points). Your responses likely showed awareness of market movements, interest in popular investments, and sensitivity to missing financial opportunities.

8. Contented Minimalist

Like Charlie Munger, you value simplicity and define "enough." This directly embodies one of Housel's core principles about the importance of knowing when you have "enough."

Score Profile: Contented Minimalists reach 30+ points, with boosts from excellent financial health (+3 points), declining income (+5 points), and moderate savings (+3 points). Your answers likely demonstrated satisfaction with modest financial goals, prioritizing life quality over wealth accumulation, and resistance to status competition.

9. Maverick Trailblazer

Like Felix Dennis, you forge your own path against conventional wisdom. This reflects Housel's ideas about independent thinking and the value of unique perspectives.

Score Profile: Maverick Trailblazers score 35+ points, with significant increases from growing income (+5 points) and challenging financial health situations (+3 points). Your answers likely showed independent thinking, willingness to take contrarian positions, and resistance to following financial crowds.

10. Steady Strategist

Like J.P. Morgan, you take a methodical, research-driven approach. This connects to Housel's emphasis on controlling what you can while accepting uncertainty.

Score Profile: Steady Strategists typically need 35+ points, with bonuses from stable income (+5 points), high savings rate (+3 points), and excellent financial health (+5 points). Your responses likely indicated analytical thinking, preference for research before decisions, and balancing risk with careful planning.

Note on Scoring: Your primary archetype is the one with your highest overall score after all behavioral responses and financial modifiers are calculated. Your secondary archetype is your second-highest score. The final mindset score shown in your results is calculated as a percentage based on your primary archetype's raw score: (Raw Score / 60) × 100, capped at 100.

How the Calculator Works

I built this calculator using sophisticated scoring algorithms that analyze both financial metrics and behavioral responses. Here's a look under the hood at how it works.

| Metric | Calculation Method |

|---|---|

| Income Trajectory | ((Current Income - Past Income) / Past Income) × 100% Growing: >10% increase Stable: ±10% Declining: >10% decrease |

| Savings Rate | (Monthly Savings × 12) / Annual Income High: >20% Moderate: 10-20% Low: <10% None: 0% |

| Financial Health | Based on Debt-to-Net-Worth ratio and absolute values Excellent: No debt Strong: <20% ratio Good: <50% ratio Fair: <100% ratio Concerning: >100% ratio |

| Behavioral Scores | Each question response adds weighted points to different archetype scores Example: "Buy more" during market drops adds points to Visionary Risk-Taker and Maverick archetypes |

| Financial Modifiers | Financial metrics modify archetype scores Example: Growing income adds points to ambitious archetypes (Visionary, Maverick) |

| Archetype Determination | Highest and second-highest scoring archetypes become primary and secondary |

| Mindset Score | Normalized percentage based on primary archetype's raw score Formula: (Raw Score / 60) × 100 (capped at 100) |

The scoring system applies weighted values to each response based on my analysis of how different behaviors correlate with financial mindsets. For example, the question about market drops is weighted 3× due to its strong correlation with loss aversion, while checking account balances is weighted 1× as a less critical indicator.

"Your personal experiences with money make up maybe 0.00000001% of what's happened in the world, but maybe 80% of how you think the world works." — Morgan Housel

My Key Takeaway from "The Psychology of Money"

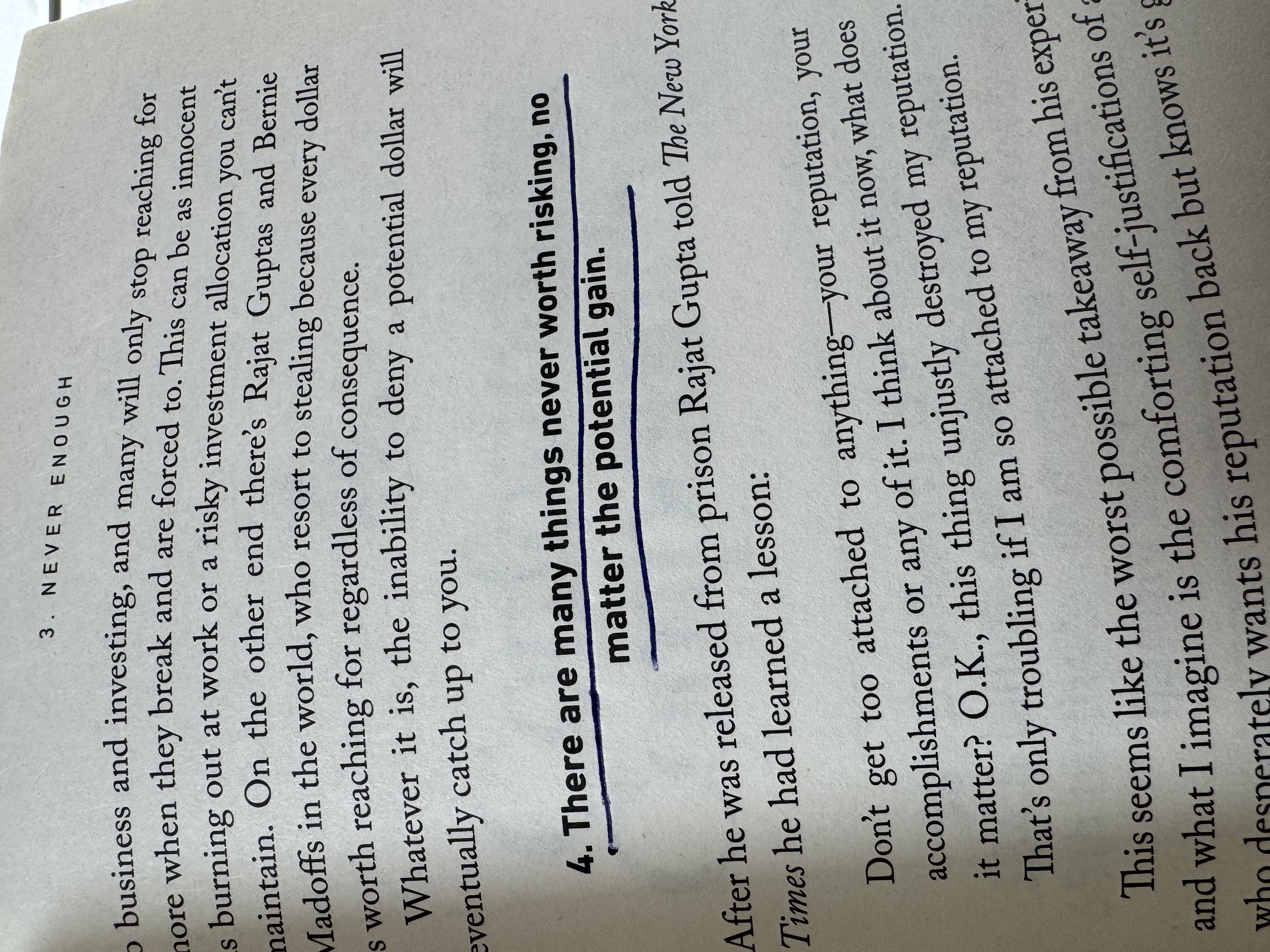

The most valuable lesson I've taken from Housel's book is that financial success isn't about what you know, but how you behave. As Housel writes, "The most important financial skill is getting the goalposts to stop moving." Understanding your financial archetype helps you recognize when your behaviors are driven by unhelpful biases rather than rational decision-making.

By identifying your archetype and understanding your financial psychology, you can develop strategies that work with your natural tendencies. Sometimes being reasonable is more important than being purely rational, as Housel emphasizes in Chapter 11 of his book. You can pick up a copy at fine retailers everywhere or online.