Salary to Hourly Calculator: Find Your True Hourly Rate

Salary to Hourly Calculator

Input Section

Advanced Options

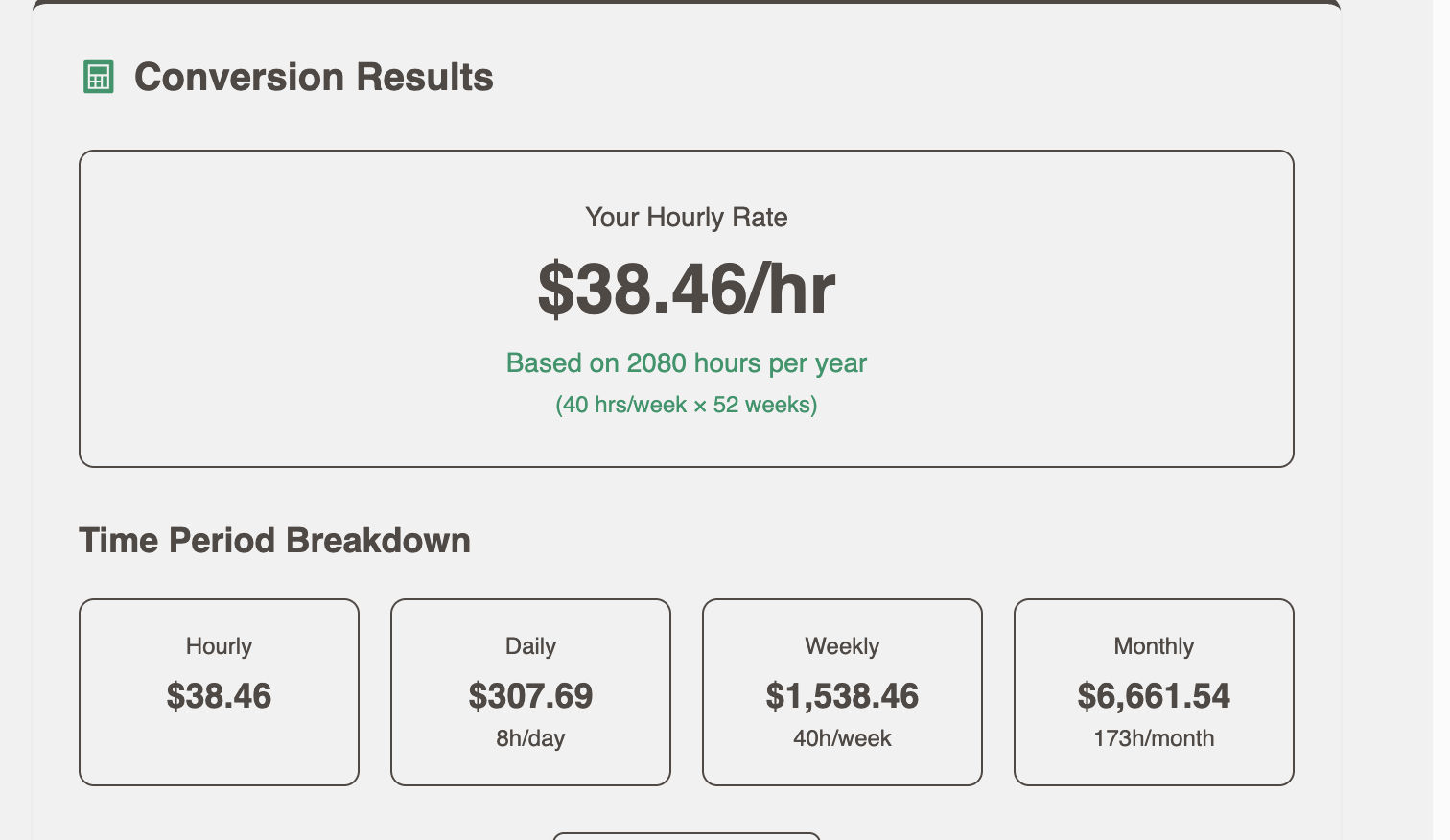

Conversion Results

How to Use This Salary to Hourly Calculator

As Bob Lotich, author of Simple Money, Rich Life, puts it: "Everyone thinks they know how much they earn like how many dollars per hour they earn but most people are wrong." This misconception is exactly why I built this calculator.

The most eye-opening realization for me was when I calculated my "actual" hourly rate from a salary position. When I factored in the 50-55 hours I was actually working per week (not the standard 40), my impressive-sounding salary translated to a much lower hourly rate than I expected. This calculation helped me negotiate for a raise and eventually transition to a role with better work-life balance.

Step 1: Choose Your Conversion Type

Select whether you want to convert from salary to hourly rate or from hourly wage to annual salary. This calculator handles both directions and provides comprehensive breakdowns for each.

Step 2: Enter Your Compensation

Enter your annual salary or hourly rate. The calculator uses realistic defaults based on current market data—$75,000 for salary (close to the U.S. median household income) and $25/hour for hourly rates.

Step 3: Choose Your Calculation Method

This is where the calculator gets powerful. You have three options:

- Standard Method: Uses the traditional 2,080 hours per year (40 hours × 52 weeks). This is what most online calculators use and what HR departments typically reference.

- Actual Time Worked: Accounts for your actual time off including vacation days, sick days, and holidays. This gives you a more accurate hourly rate based on hours you actually work.

- Custom Hours: Lets you specify exactly how many hours per week and weeks per year you work. Perfect for part-time, overtime, or irregular schedules.

Understanding the Standard vs Actual Method

Here's a real example that shows why this matters. Let's say you earn $75,000 per year:

| Method | Working Hours/Year | Hourly Rate |

|---|---|---|

| Standard (2,080 hours) | 2,080 hours | $36.06/hour |

| Actual (15 vacation + 5 sick + 8 holidays) | 1,856 hours | $40.41/hour |

The "actual" method shows you're earning $4.35 more per hour than the standard calculation suggests, because you're working fewer hours due to time off.

Advanced Features

The calculator includes several advanced features that make it more comprehensive than basic conversion tools:

- Overtime Analysis: If you work more than 40 hours per week, see how overtime pay (time-and-a-half) affects your total compensation.

- Tax Estimates: Get a rough estimate of your after-tax income and net hourly rate.

- Benefits Comparison: Compare the total value of salary vs hourly positions by including benefits packages.

When to Use Each Conversion

Salary to Hourly: Use this when you're evaluating whether your salary is competitive, negotiating for a raise, or considering a switch to hourly work. It's also helpful for freelancers who want to set hourly rates based on their previous salary.

Hourly to Salary: Use this when you're considering a salaried position and want to know the annual value of your hourly rate, or when negotiating salary based on your current hourly compensation.

Calculation Formulas and Methods

Understanding the exact formulas behind this calculator helps you make informed decisions. Here are the core calculations used:

Basic Salary to Hourly Conversion

Hourly Rate = Annual Salary ÷ Total Working Hours Per Year

Example: $75,000 ÷ 2,080 = $36.06/hour

Hourly to Salary Conversion

Annual Salary = Hourly Rate × Total Working Hours Per Year

Example: $25/hour × 2,080 hours = $52,000/year

Overtime Calculations

When working more than 40 hours per week, overtime pay (time-and-a-half) applies:

Regular Pay = Hourly Rate × 40 hours

Overtime Pay = (Hourly Rate × 1.5) × Overtime Hours

Weekly Total = Regular Pay + Overtime Pay

Annual Total = Weekly Total × Weeks Worked

Tax Estimate Calculations

After-Tax Income = Gross Income × (1 - Tax Rate)

After-Tax Hourly Rate = After-Tax Income ÷ Total Hours

Example: $75,000 × (1 - 0.22) = $58,500 after taxes

$58,500 ÷ 2,080 hours = $28.13/hour after taxes

Benefits Comparison

To compare total compensation including benefits:

Total Compensation = Base Salary + Benefits Value

Adjusted Hourly Rate = Total Compensation ÷ Total Hours

Example: $75,000 salary + $15,000 benefits = $90,000 total

$90,000 ÷ 2,080 hours = $43.27/hour (true value)

Real-World Applications

I've used variations of these calculations throughout my career. Here are some practical ways you can use it too.

- Salary Negotiation: When my employer offered me a salary position, I calculated that my current hourly rate × 2,080 hours was significantly higher than their offer. This helped me negotiate a better starting salary.

- Freelance Pricing: When I started consulting, I used my previous salary to set my hourly rate, adding a premium for the lack of benefits and job security.

- Job Comparison: When choosing between two offers—one salary and one hourly—I used the benefits comparison feature to see which offered better total compensation.

Common Calculation Mistakes to Avoid

Don't forget about benefits: A $75,000 salary with full benefits can be worth $90,000+ when you factor in health insurance, 401k matching, and paid time off. As my career has grown, I've been employed by companies with much better work-life balance and benefits. I now get "mental health days" and other holidays I never had before, plus unlimited time off where I use about 3-4 weeks per year for vacation. This generous time off really bumps up the value of your salary and average hourly earnings estimate, so make sure to take a broader view of compensation when evaluating job offers.

Consider your actual working hours: If you regularly work 50+ hours per week on salary, your effective hourly rate is much lower than the standard calculation suggests. In my first job out of college, I was given a salary of $32,000 per year and was pumped because it was my first paying office job where I got to work at a desk instead of doing manual labor or waiting tables. But I soon learned that a salary position isn't always the best if you have to work 40+ hours per week. Some weeks I was working weekends, getting into the office before 7 AM and leaving after 5 PM. When I think about it in retrospect, some weeks I was probably only making around $12 per hour for my efforts. This was a valuable lesson in understanding true hourly value.

Account for unpaid time off: Hourly workers often don't get paid vacation or sick days, which significantly impacts annual earnings.

Consider the hidden costs of job stress: Bob Lotich makes an important point that often gets overlooked: "If you have a job that's super stressful and you get home and you just aren't on your A game... like that needs to be factored in the equation." A high-paying but stressful job might cost you in health, relationships, and overall quality of life—factors that pure hourly calculations can't capture.

Industry Context

According to the Bureau of Labor Statistics, the average hourly wage for all employees was $36.24 as of May 2024. However, this varies significantly by industry and location. Use this calculator to see how your compensation compares and to make informed career decisions.

Related Calculators

Now that you understand your hourly rate, explore these related tools to maximize your compensation strategy:

Time and a Half Calculator

Calculate your overtime pay when working more than 40 hours per week. Essential for understanding how extra hours translate to additional income and planning your work schedule for maximum earnings.

Pay Raise Calculator

Understand how a raise will impact your paycheck, including the effects of taxes and deductions. Perfect for salary negotiations and evaluating job offers to see the real financial impact of compensation changes.