Time and a Half Calculator: Calculate Overtime Pay w/ Taxes

Time and a Half Calculator

Input Section

Earnings Statement

(Click Calculate to see results)Earnings

| Description | Amount |

|---|---|

| Regular Pay | $0.00 |

| Time and a Half Pay | $0.00 |

Total Amount Earned

How to Use This Calculator

This time and a half calculator helps you quickly determine your overtime pay and total earnings. Whether you're working time and a half, double time, or triple time hours, this tool calculates both your gross and net pay after taxes and deductions. Enter your hourly rate, hours worked, and any deductions to see your complete paycheck breakdown in a clear, paycheck stub format.

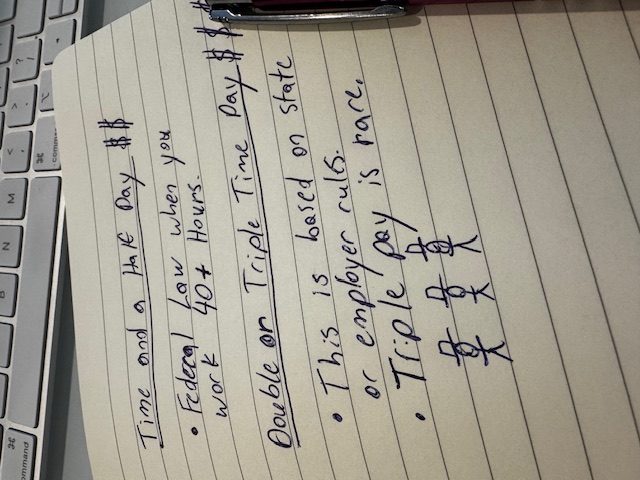

According to federal law, most non-exempt employees are entitled to overtime pay when they work more than 40 hours in a workweek. The standard overtime rate is time and a half (1.5x your regular rate), but some situations may qualify for double time or even triple time pay, especially during holidays like Christmas, July 4th, and Labor Day, or when working extremely long shifts.

Step 1: Select Your Overtime Type

Choose between three common overtime pay structures:

- Time and a Half (1.5x): The most common overtime rate in the United States. For example, if you earn $20/hour regularly, time and a half pays $30/hour.

- Double Time (2x): Often paid for holidays, Sundays, or excessive overtime hours. A $20/hour rate becomes $40/hour at double time.

- Triple Time (3x): Less common but sometimes offered for extreme circumstances or premium holidays. Your $20/hour rate would jump to $60/hour.

Step 2: Enter Your Pay Information

Fill in your wage and hours information:

- Regular Hourly Pay Rate: Your standard hourly wage before any overtime multipliers

- Regular Hours: Hours worked at your normal pay rate (typically up to 40 hours per week)

- Overtime Hours: Hours worked at the selected overtime rate

Step 3: Add Tax and Deduction Information (Optional)

For a more accurate net pay calculation, you can include:

- Tax Rate: Your estimated tax percentage (federal, state, and local combined)

- Custom Deductions: Add any payroll deductions like 401(k) contributions, health insurance premiums, or other withholdings. You can specify each as either a dollar amount or percentage of gross pay.

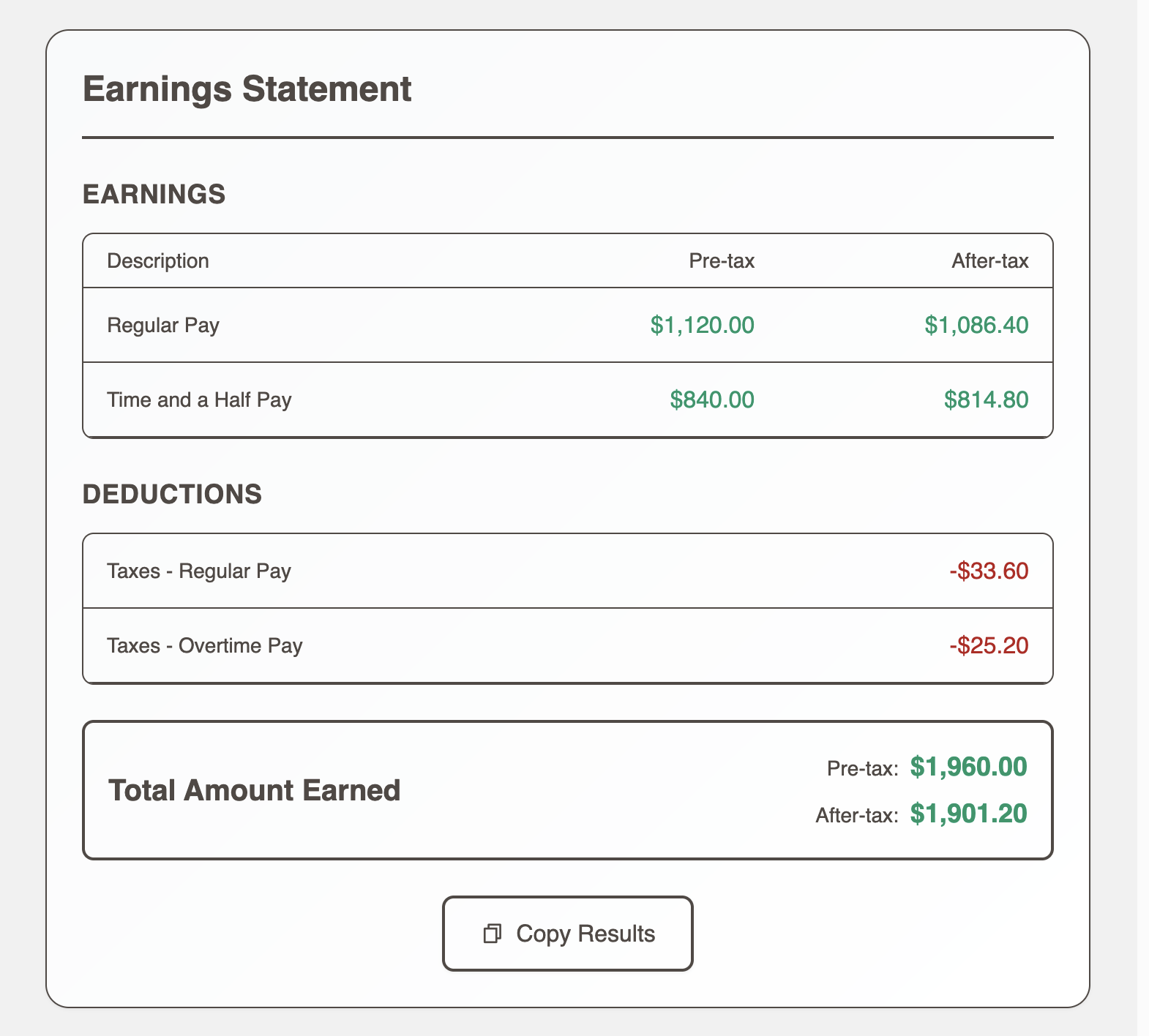

Step 4: Calculate and Review Results

Click "Calculate Pay" to see your complete earnings breakdown displayed in a professional paycheck stub format. The results show:

- Regular and overtime pay (both pre-tax and after-tax)

- All deductions itemized

- Total gross and net earnings

Use the "Copy Results" button to save your calculations for your records or to share with your employer.

What is Overtime Pay?

Overtime pay is additional compensation paid to employees who work beyond their standard hours. The most common reason employees receive overtime is working more than 40 hours in a single workweek. However, you may also earn overtime pay for working on national holidays like Christmas, July 4th, and Labor Day, or for working extremely long shifts in a single day.

A Brief History of Overtime Pay

On June 25, 1938, in the midst of the Great Depression, President Franklin Roosevelt signed the Fair Labor Standards Act (FLSA), a landmark law that mandated a national minimum wage, ended child labor, and set out regulations for overtime pay. According to WNYC Studios' brief history of overtime, this legislation was revolutionary in protecting workers' rights and ensuring fair compensation for extended work hours.

When Do You Qualify for Overtime?

According to the U.S. Department of Labor, most hourly workers are entitled to overtime pay when they work more than 40 hours in a workweek. However, there are important considerations:

- Non-exempt employees: Generally entitled to overtime pay

- Exempt employees: Typically salaried workers in executive, administrative, or professional roles who don't receive overtime

- State laws: Some states have additional overtime requirements, such as daily overtime for hours over 8 in a day

When You Get Double Time and Triple Time

While federal law only requires time and a half for hours over 40 in a workweek, double and triple time rates are determined by state laws, union agreements, or employer policies. Here's when you might be able to earn these higher rates.

Double time is most commonly paid for:

- Working on certain holidays (like Christmas, New Year's Day, or other federally recognized holidays).

- Working more than 12 hours in a single day (in some states like California).

- Working 7 consecutive days in a workweek (seventh day worked).

- Some union contracts specify double time for particular circumstances.

Triple time is much less common but may occur for if you work extremely long shifts or are in a specialized industry or have a specific union agreement.

The exact rules vary significantly by state laws, industry and union contracts, company policies, and whether you're exempt or non-exempt from overtime laws.

Common Overtime Scenarios

Based on my research, here are typical overtime situations you can model with this calculator:

| Scenario | Common Rate | Example |

|---|---|---|

| Standard Overtime (40+ hours/week) | Time and a Half (1.5x) | 45 hours = 40 regular + 5 overtime |

| Sunday Work | Double Time (2x) | 8 hours on Sunday at 2x rate |

| Major Holidays | Double or Triple Time | Christmas Day at 3x rate |

| Emergency Call-ins | Time and a Half minimum | Called in on day off |

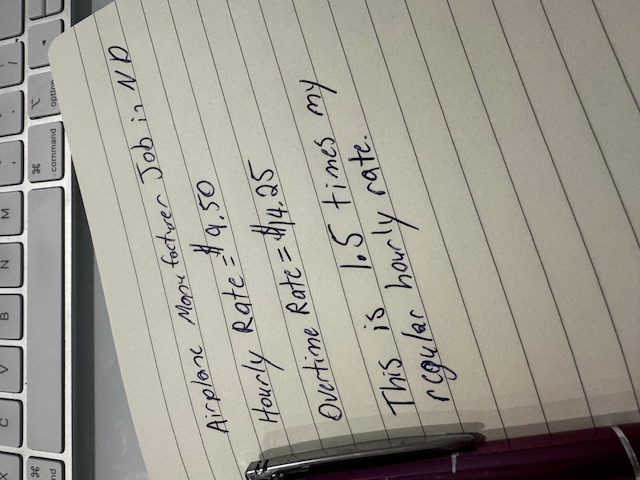

My Personal Experience with Overtime Pay

Back when I was an hourly employee, I used to love getting paid time-and-a-half. I had the opportunity to pick up extra shifts at a manufacturing job back in college. My standard hourly wage was $9.50 per hour, so being able to make $14.25 per hour with time-and-a-half pay felt like I was making progress much faster. The only downside is that I didn't enjoy the job.

I've had salary positions for most of my adult life, so I haven't been able to take advantage of overtime. But I did encounter a situation where I could get overtime pay for coming in and working a few Saturday mornings. The company gave me a set bonus for this additional extra work of around $225. Keep in mind this was more than a decade ago, and the extra income really helped out paying off some of the student loan debt and offered a bit more breathing room.

Calculating Time and a Half: Examples

Let's walk through some real-world examples to show how overtime calculations work:

Example 1: Basic Time and a Half

Sarah works as a retail associate earning $15 per hour. This week she worked 45 hours.

- Regular hours: 40 hours × $15 = $600

- Overtime rate: $15 × 1.5 = $22.50 per hour

- Overtime hours: 5 hours × $22.50 = $112.50

- Total gross pay: $600 + $112.50 = $712.50

Example 2: Double Time Holiday Pay

Mike works in a warehouse earning $20 per hour. He worked 8 hours on Thanksgiving (double time).

- Regular rate: $20 per hour

- Double time rate: $20 × 2 = $40 per hour

- Holiday pay: 8 hours × $40 = $320

- Total for the day: $320

Calculator Formulas and Methodology

Here are the exact formulas I applied to this calculator so you understand how it works.

Basic Overtime Calculations

| Calculation Type | Formula | Example |

|---|---|---|

| Regular Pay | Hourly Rate × Regular Hours | $20 × 40 hours = $800 |

| Time and a Half Rate | Hourly Rate × 1.5 | $20 × 1.5 = $30/hour |

| Double Time Rate | Hourly Rate × 2 | $20 × 2 = $40/hour |

| Triple Time Rate | Hourly Rate × 3 | $20 × 3 = $60/hour |

| Overtime Pay | Overtime Rate × Overtime Hours | $30 × 10 hours = $300 |

Tax and Deduction Calculations

| Calculation | Formula | Notes |

|---|---|---|

| Regular Pay Tax | Regular Pay × Tax Rate | Applied to all regular hours |

| Overtime Pay Tax | Overtime Pay × Tax Rate (or $0 if tax-free) | Can be set to $0 with tax-free option |

| Dollar Deductions | Fixed Amount | 401k, insurance premiums |

| Percentage Deductions | Gross Pay × Percentage | Calculated on total gross pay |

| Net Pay | Gross Pay - Taxes - Deductions | Your take-home amount |

The Future of Overtime Taxation

If you regularly work overtime, I have good news. There's a bill being proposed called the No Tax on Overtime Act of 2025. This bill would remove taxes on overtime compensation, meaning putting in the extra hours at work could be even more valuable to you if it's passed.

This calculator allows you to check a box to see how much extra income you'll make due to not being taxed on overtime, so you can understand the impact on your finances if this legislation does go through and become law. The potential savings could be significant for workers who regularly put in overtime hours.

Overtime Pay Laws and Regulations

Understanding your rights regarding overtime pay is crucial for ensuring fair compensation. The Fair Labor Standards Act (FLSA) establishes minimum wage, overtime pay, recordkeeping, and youth employment standards.

Federal Overtime Requirements

Under federal law:

- Overtime must be paid at 1.5x the regular rate for hours over 40 in a workweek.

- A workweek is a fixed 168-hour period (7 consecutive 24-hour days).

- Overtime pay cannot be waived by agreement between employer and employee.

- Compensatory time off in lieu of overtime pay is generally not allowed for private sector employees.

State-Specific Overtime Laws

Some states have additional overtime protections:

- California: Overtime for hours over 8 in a day, double time for hours over 12.

- Alaska, Nevada, Puerto Rico: Overtime for hours over 8 in a day.

- Colorado: Overtime for hours over 12 in a day.

Frequently Asked Questions

Is overtime calculated daily or weekly?

Under federal law, overtime is calculated on a weekly basis (hours over 40 in a workweek). However, some states like California also require daily overtime for hours over 8 in a single day.

Are bonuses included in overtime calculations?

Non-discretionary bonuses (like production bonuses) must be included in the regular rate of pay for overtime calculations. Discretionary bonuses (like holiday bonuses) are typically excluded.

I'm on salary. Can I get overtime?

It depends on whether you're classified as exempt or non-exempt. Non-exempt salaried employees are entitled to overtime. Exempt employees (meeting specific criteria for executive, administrative, or professional roles) usually don't get overtime. Sorry!

Check out my Pay Raise Calculator to see how salary increases impact your earnings, or the Opportunity Cost Calculator to evaluate what to do with your overtime earnings.